Assessor

The township assessor establishes values on all parcels of property within Jackson Township and then reports to the Will County Supervisor of Assessments. The Assessor’s Office maintains property record cards and can also provide additional information on the many facets of the assessment cycle, appeal process, and senior exemptions. Residents are welcome to discuss their assessment property details by appointment.

Delilah LeGrett. She earned her CIAO in 2019 from the Illinois Property Assessment Institute. Delilah is a life long Jackson Township resident and currently resides with her husband and 5 kids. She also volunteers with the Manhattan Girl Scouts and provides Notary services to the public.

Assessment Info

Property Search

Exemptions

FAQ

Property Tax Assessments can be discussed and/or appealed after the Revised Assessment Notices have been Published. This year, the published date was August 6th, 2025. The deadline to appeal the revised assessment is September 8, 2025. The Will County Supervisor of Assessments has prepared a guide for filing an appeal; you can view that HERE or visit their website

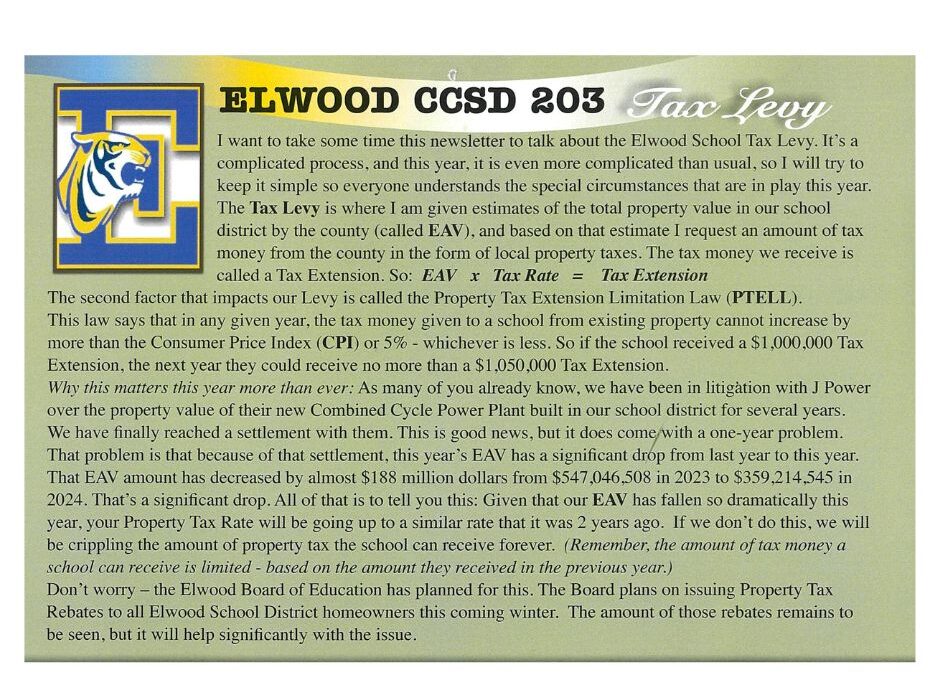

The Spring, 2025 Elwood Community Newsletter contained a very informative article on the Elwood School Tax Levy and how it is impacting your property taxes; see the article to the left. You can also view the article HERE.